Uh-oh: It’s a bank overdraft

What it is and how overdraft coverage may help you avoid it

If you have a checking account, you probably understand the basics: You put money in, the bank holds onto it, and then you’re able to get cash from an ATM, write checks or use your debit card for everything from gas to groceries. With every transaction, money is taken out of your account.

But what happens if you spend $125 on groceries and remember (a little too late) that your checking account balance is $100?

You’ve just entered The Overdraft Zone. Your checking account balance has dropped below zero. When you look at your account balance, you might see a negative number. There may also be a notice alerting you to the overdraft on your account.

If it’s the first time this has happened to you, the word "overdraft" may catch you by surprise. You might be asking yourself questions like: Can I withdraw money if my account is overdrawn? How long can my checking account be overdrawn? And does an overdrawn account affect my credit?

Let’s take a look.

How does an overdraft work?

It depends. Some banks may cover a check or recurring withdrawal, such as a monthly gym membership, even if you don’t have enough funds in your account at the moment.1 Sometimes, a purchase is simply declined. And other times, your bank may let the purchase go through, then charge you a fee later.

Generally, people must opt-in to allow their bank to charge an overdraft fee and allow a transaction.1 Keep in mind overdraft fees are different from non-sufficient (NSF) fees. The two are similar, but there may be no choice to opt in when it comes to NSF fees.1

Banks and credit unions have different ways of handling overdrafts for their customers, so it’s helpful to go over those details whenever you open a checking account. That way, you’ll know exactly what to expect if you mistakenly spend more than you have. This will also help you set up your account in a way that works for your lifestyle and spending habits.

How does overdraft protection work?

If you want to get overdraft protection, you have a few options, but many involve fees, so don’t be afraid to ask for details. If you don’t agree to overdraft protection ahead of time, you can’t be charged a fee.1 But if you try to spend more than you have, the purchase generally won’t go through. Here are some other overdraft options to think about:

- Savings link: You can link your checking account to another account at your bank, such as your savings. This way, if you’re overdrawn, the bank will move funds from your savings into your checking to cover the difference. Sometimes, this overdraft option can be free.

- Line of credit: With an overdraft line of credit, the bank will loan you the amount needed to cover the transaction. You may even be able to use this account in an emergency. Since it’s really a loan, you’ll have to pay interest on the money covering your overdraft, but it may amount to less than typical overdraft fees.2

- Credit card link: Linking your checking account to a credit card is possible, too. If your checking or savings account can’t cover a charge, the balance would be placed on your credit card for you to pay off later. But there might still be a fee.3

One benefit of overdraft protection is that you might avoid a hefty fee added to a late payment, such as a house or car payment. But you’ll have to compare the fees that come along with each situation to make the best decision.

How much are bank overdraft fees?

On average, an overdraft will cost you around $35 for each transaction.1 Some banks will charge more and some will charge less.

While fees are no picnic, an overdraft may not have to slow you down for long. As soon as you pay the amount you owe from overdrawing and bring your account balance into the black, you can usually continue using the checking account again.

To protect your account and your credit, it’s a good idea to straighten things out as soon as possible. If an account is left overdrawn, some banks may charge additional fees for each day the account is overdrawn.1

How can I prevent an overdraft on my account?

Luckily, there are plenty of nifty tools to help you avoid an overdraft. Here are a few you might try:

- Get alerts: Ask your bank to tell you if your checking account drops to a certain level. You’ll be able to shift funds from a different account, or make a deposit before the balance dips into the danger zone.

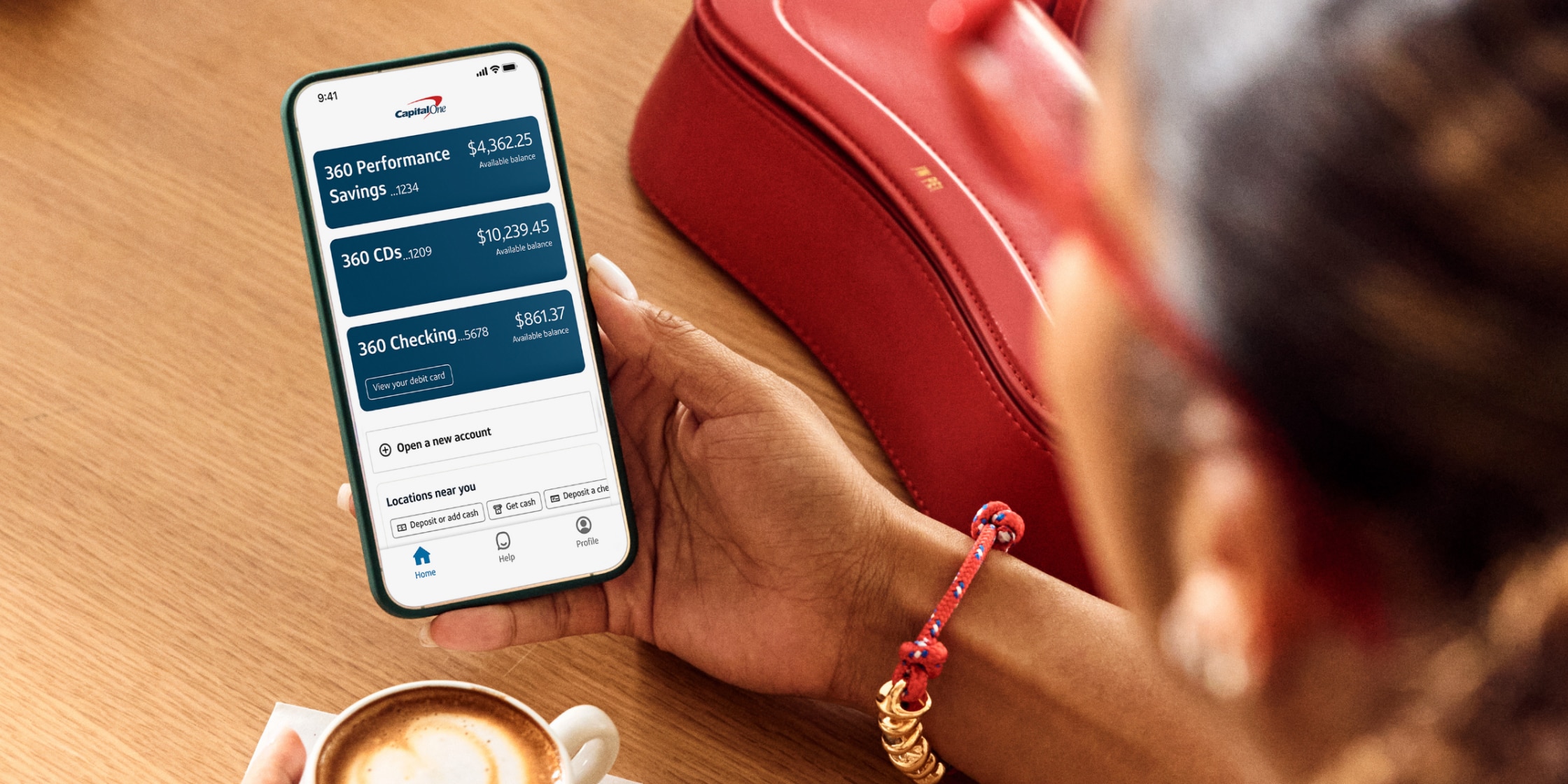

- Check in regularly: Make a habit of checking your account balance from your phone every day. It will only take a minute and will help you stay on top of your money all month long.

- Build a buffer: Think about adding a certain amount, such as $100, to your checking account. Make it your new "zero balance." That way, if you slip up (and it happens), there’s already a cushion in place.

- Ask for help: Check with your bank to see what other tools may be available to help keep your account in the black.

Dealing with an overdraft is a bummer, but mistakes happen. Knowing you have options can put you in a better position to manage your money and hopefully avoid getting into the red. If you’re dealing with overdrafts more than you’d prefer, it may help to create a simple budget. Sometimes, just getting a clearer picture of what’s coming in–and what’s going out–can help you stay ahead of the game.